Four Reasons Tesla's Profits Dropped 23% – Not All Blame on Musk

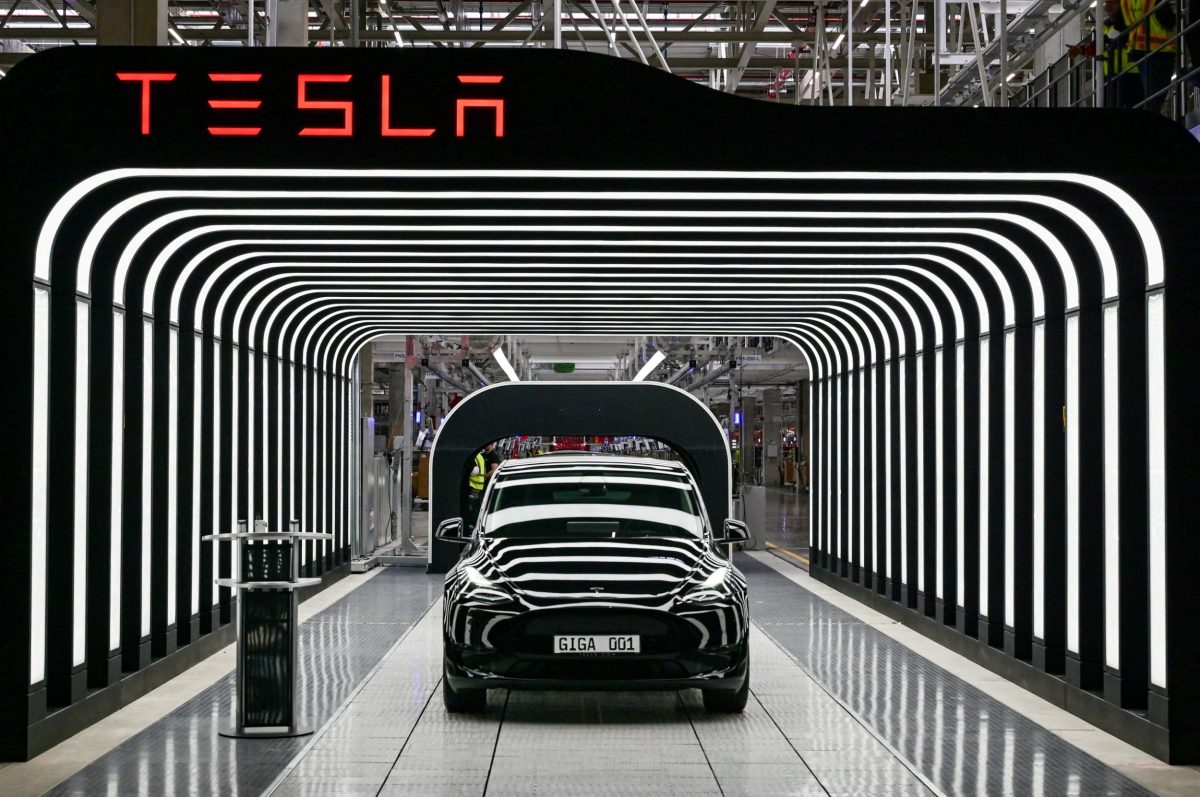

Tesla Faces Significant Challenges Amid Sales Decline and Leadership Controversies

Tesla has experienced a sharp decline in profits, with a 23% drop attributed to a continued slump in global electric vehicle (EV) sales. The company’s performance has been further impacted by the fallout from CEO Elon Musk’s public conflicts, particularly his association with former U.S. President Donald Trump.

In the second quarter, Tesla reported a revenue decline of 12%, reaching $22.5 billion. This was driven by a 13.5% decrease in car deliveries compared to the same period last year. Specifically, the company sold 384,122 vehicles during this time, down from 443,956 in the previous year. The car business saw a 16% revenue drop, while the battery energy division also fell by 7%.

Despite efforts to revamp its Model Y and refresh its luxury models S and X, as well as launching a more affordable version of the Cybertruck, Tesla’s sales have not rebounded. Additionally, the company has repeatedly delayed the production of a cheaper model, which it continues to promise is in development.

Chinese Competition Intensifies

Chinese automakers are increasingly challenging Tesla's dominance, especially in the domestic market. Companies like BYD and Leapmotor have taken significant market share from Tesla in China and are now expanding their presence globally. In the UK and other European markets, affordable EV options are becoming more prevalent, with Leapmotor offering one of the cheapest EVs at £14,999.

BYD has already surpassed Tesla as the world’s top-selling EV manufacturer. Other Chinese companies, such as Xiaomi, are also entering the EV market, intensifying competition for Tesla.

Regulatory Credits Decline

A major source of revenue for Tesla has been the sale of regulatory credits, which are given to automakers that meet environmental standards. These credits can be sold to manufacturers who do not meet emissions requirements. Last year, Tesla earned $2.8 billion from these credits. However, recent figures show a significant drop, with revenue from this area falling to $439 million, down from $890 million a year earlier.

The U.S. government has also revised its policies on EV incentives, eliminating the $7,500 consumer tax credit and reducing valuable carbon credits that other manufacturers previously paid to Tesla. This shift has further affected Tesla’s revenue stream.

Reputational Damage and Political Backlash

Tesla’s struggles are partly due to a backlash in the U.S. and Europe following Musk’s strong support for Trump’s re-election campaign. Musk later led the Department of Government Efficiency (Doge), which was seen as cutting federal jobs and rolling back regulations. Although he stepped down in May, concerns remain about his ability to focus fully on Tesla.

Musk has continued to engage in public disputes with Trump on social media, which has further complicated his relationship with potential customers. In Germany, his support for the anti-immigrant AfD party and a controversial gesture during a political rally sparked significant criticism.

Robotaxis and Public Perception

Musk has encouraged investors to look ahead to future opportunities, particularly in autonomous vehicles and robotics. Tesla launched its robotaxi fleet in a small area of Austin, Texas, but the response has been mixed. A survey conducted by the Electric Vehicle Intelligence Report found that over half of respondents were less convinced of the safety of Tesla’s robotaxis, with 30% believing self-driving taxis should be illegal.

Despite the limited rollout and lukewarm reception, Musk remains optimistic about the future, predicting millions of autonomous Teslas operating by the second half of 2026.

Analyst Perspective

Analyst Jacob Bourne noted that while Tesla’s results are disappointing, the company still has a strong foundation in key growth areas such as energy storage, robotics, and AI-powered transportation. He emphasized the importance of leadership execution in a fast-moving market.